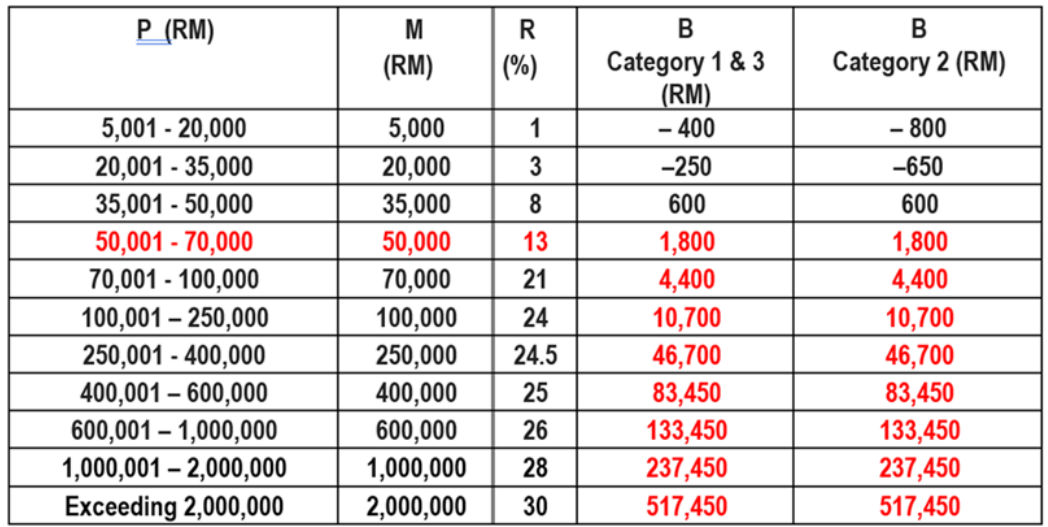

The rate of monthly contributions specified in this Part shall apply to the following. Ref Contribution Rate Section E RM5000 and below.

Rates Of Pf Employer And Employee Contribution Pf Provident Fund

Aemployees who are Malaysian citizens.

. 08 January 2019 The minimum statutory contribution by employers to Malaysias Employees Provident Fund EPF for employees aged above 60 will be reduced to. Conduct of Probationary Exam. So lets use this for the example.

Wages up to RM30. The employees contribution of 12 is entirely credited in the. Contribution By Employer Only.

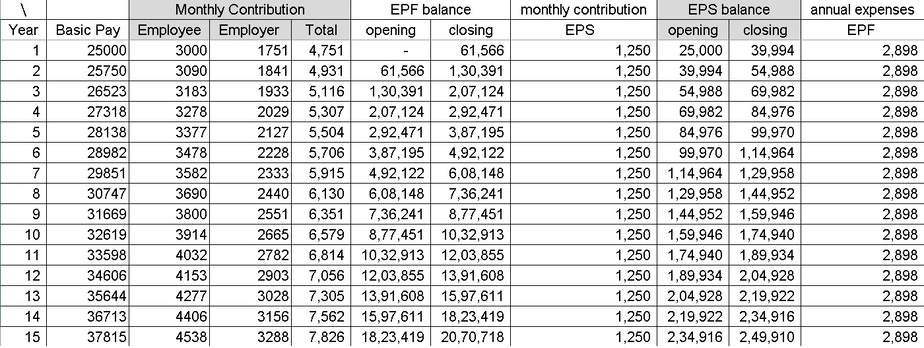

In March this year the EPFOs Central Board of Trustees headed by Gangwar had recommended 85 per cent interest rate for EPF subscribers for 2019-20. The below is the given details of employee and employer contribution towards EPF. Employees contribution towards EPF 12 of 30000 3600.

For employees who receive wagessalary of RM5000 and below the portion of employees contribution is 11 of their monthly salary while the employer contributes 13. Employee Contribution EPF12 100001200 Employer Contribution EPS83310000833 Difference1200-833367 Total Employer8333671200. So the Total EPF contribution every month Rs 6000 Rs 1835 Rs 7835.

13 Ref Contribution Rate Section A Applicable for ii and iii only. The epf contribution rate table is as below. Employees until the employees attain the age of sixty years.

Employees Deposit linked insurance. Employees Provident Fund EPF 367. When wages exceed RM30 but not RM50.

Employees Provident Fund EPF is a retirement benefits scheme where the employee contributes 12 of his basic salary and. If you are looking for more information on EPF interest rates 2022-23 find the details on Unacademy. From the employers share of contribution 833 is contributed towards the Employees Pension Scheme and the remaining 367 is contributed to the EPF Scheme.

Here is how it is calculated. The employer and employee both are required to contribute 12 of Basic salary Dearness Allowance to the EPF account. Revised rate of interest with regard to Staff Provident Fund in EPFO HONoHRD322012SPF642 dated 28072022 13MB 125.

For most employees the PF contribution is 12 of the basic salary. According to the EPF Act an employee is required to contribute a minimum of 8 and the employer a minimum of 12 of the total earning of the employees monthly salary. 367 Employees Pension scheme AC 10 0.

EPF Account Balance Start of April. The company will pay 175 while the staffworkers will contribute 05 of their wages for the employment injury insurance scheme. So your and your employers EPF contributions started for the financial year 2018 2019 from the month of April.

Employer contribution Employee provident fund AC 1 12. The EPF interest rate for FY 2018-2019 was 865. Employer Contribution to EPF The employer contributes 12 of salary which is distributed as 833 towards the Employees Pension Scheme and 367 towards the.

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

Download Kwsp Rate 2020 Table Background Kwspblogs

What Is The Epf Contribution Rate Table Wisdom Jobs India

Socso Table 2019 For Payroll Malaysia Smart Touch Technology

20 Kwsp 7 Contribution Rate Png Kwspblogs

Epf Employer Contribution Rate Rylandcxt

Epf A C Interest Calculation Components Example

Epf Employer Contribution Rate Rylandcxt

Epf Historical Returns Performance Mypf My

Download Employee Provident Fund Calculator Excel Template Exceldatapro

Higher Epf Contribution On Basic Allowances Calculate Increase In Epf Corpus

Kwsp Epf Sets Rm228 000 As Minimum Target Savings At Age 55

2019 Epf Updates Include Decreasing Senior Staff Contribution To 4

Higher Epf Contribution On Basic Allowances Calculate Increase In Epf Corpus

Epf Interest Rate 2021 22 How To Calculate Interest On Epf

Download Employee Provident Fund Calculator Excel Template Exceldatapro